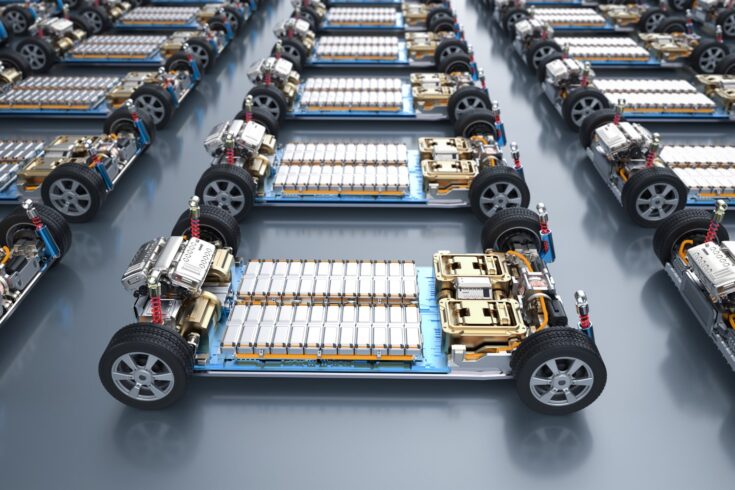

UK-based EV battery start-ups have raised $2.7 billion in funds since 2018.

The report was commissioned by UK Research and Innovation’s (UKRI) Faraday Battery Challenge, delivered by Innovate UK and produced by Dealroom.

The report also highlights the UK’s leading role in furthering the development of groundbreaking EV battery innovations.

For the UK EV battery market, 2023 was a strong year, with $1.3 billion of private investment in EV battery start-ups.

Fourth largest investment recipient

The UK now ranks as the fourth largest EV battery VC investment recipient since 2018, following the US, China and Sweden. It has one of the strongest VC investment growth in recent years, moving up to third place in 2023 and 2024.

The Faraday Battery Challenge has been crucial in advancing the UK EV battery sector, supporting 52 UK startups valued at over $2 billion and raising $1 billion in VC investment since 2018.

Beyond EV batteries, the Faraday Battery Challenge has funded more than 100 UK start-ups in related sectors:

- creating an ecosystem valued at over $3.2 billion

- raising $1.6 billion since 2018

- employing 2,400 people in the UK

Outperforms other major economies

The new report also highlights:

- the UK outperforms other major economies (per capita and GDP), like the US, Germany and France, while being outranked by Sweden, Norway and Estonia

- the UK ranks sixth by combined enterprise value of VC-backed EV battery startups, with China (CATL), the US, and Sweden (Northvolt) creating the most value

- close to half of UK EV jobs have been created by start-ups founded in the last 10 years

- the top VC investment segment in the UK by VC investment raised since 2018 is EV battery recycling and second use, with over $1.2 billion

Looking towards the international EV battery market, the report also found that:

- global EV battery VC funding has risen thirty-fold in the past decade

- investors provided $8 billion in global EV battery VC funding in 2023 alone

- funding in 2024 has started slower for VC funding amount, mostly due to fewer megarounds, reflecting broader trends in the global venture capital market

A notable uptick in demand

The report’s findings suggest a notable uptick in demand from investors over the past five years especially, both globally and in the UK.

In the UK, a government-led move to have 100% of new cars and vans to be zero emission by the 2030s may be a factor in keeping investors enthused about funding further development and innovation of EV battery technology.

Raising over $1.6 million in funding

Thomas Bartlett, Deputy Challenge Director at the Faraday Battery Challenge, said:

The global EV battery ecosystem is accelerating at an unprecedented pace, attracting record-breaking investments that are leading to increasing innovations and success stories.

The UK’s own EV battery ecosystem is reaping the benefits of this boom, as we have seen Faraday Battery Challenge-funded start-ups and scale-ups raise over $1.6 billion in VC funding since 2018. The bulk of this investment has been made in the last two years alone, suggesting that demand to invest is only getting stronger.

Signs of healthy investment in the UK EV battery sector come at a crucial juncture, as 17.9% of the UK EV market sales consist of battery-powered EVs as of May 2024.

This leaves the UK within reaching distance of hitting the Zero Emissions Vehicle (ZEV) mandate. The UK has also recently hit the milestone of over one million EVs on British roads.

A leading role in UK growth

Yoram Wijngaarde, CEO and founder at Dealroom.co said:

Electric vehicles and the EV battery ecosystem are a huge opportunity for innovation, impact and growth. Startups are already playing a role at every stage of the supply chain, from material production to recycling. Not only will EV battery demand continue to grow, but it will also become part of each country’s critical infrastructure.

The UK’s homegrown EV battery ecosystem, while nascent, is among the best-funded so far. It is well positioned to play a leading role in UK growth, and sustainable technological resilience.

Further information

The Faraday Battery Challenge is a £610 million UKRI Challenge Fund investment started in 2017, assigned to deliver a mission-led research and innovation programme to make the UK’s EV battery market more competitive.

It does so through funding which covers lab-to-factory development, cutting-edge research and national scale-up infrastructure.

The Faraday Battery Challenge has funded 172 UK companies, 109 of which are start-ups. 52 companies are based directly in EV battery manufacture and 50 are based in EV charging, stationary energy storage and other related technologies.

Learn more about the future of the UK’s EV battery market and explore investment opportunities.