This follows further investment into its patient capital fund by UK Research and Innovation (UKRI) and the Ministry of Defence (MOD).

Continued investment in UKI2S, which is managed by impact-led venture capital firm Future Planet Capital, reflects its excellent track record of nurturing ground-breaking businesses and fostering sustainable growth across the UK.

Since its inception in 2002, UKI2S has had a remarkable impact on the UK economy:

- UKI2S has invested £30 million in over 90 companies, providing crucial support to emerging innovators

- investments have attracted an impressive return of more than £700 million in private sector investments, showcasing its ability to catalyse additional funding

- approximately 47% of private investors are based overseas, reflecting significant foreign investment flowing into the UK

- for every £1 invested by UKI2S public partners, a return of £25 is achieved in private sector investment, underscoring the fund’s effectiveness in driving growth

- UKI2S-supported companies have created over 1,100 high-quality jobs, with an average salary exceeding £50,000, boosting the nation’s employment landscape

- in a commitment to the government’s Levelling Up agenda, 50% of total investments have been made outside London and the Greater Southeast, promoting economic growth in other UK regions

- an independent assessment of the economic and wider benefits of UKI2S (PDF, 3.9MB) in 2020 revealed that an impressive 75% of companies would not have started up without the support of the fund

Creating real-world impact

Companies supported by UKI2S have continued to grow by garnering additional funding from other public and private sector investors, enabling them to create impact and solve real-world challenges. This includes:

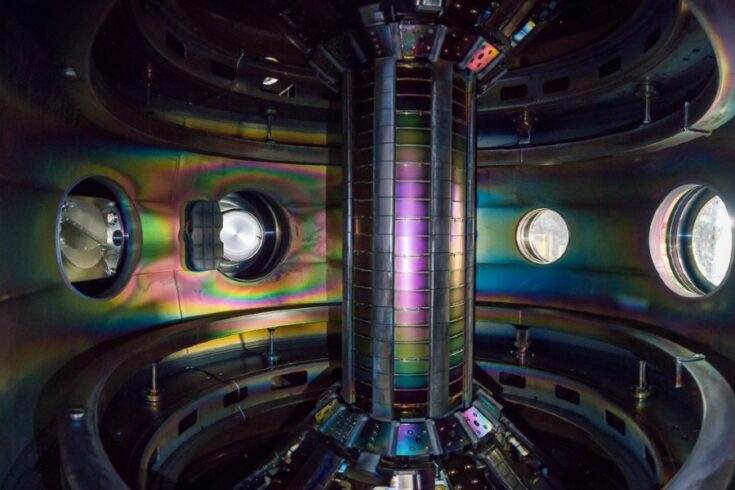

- pushing the boundaries of fusion energy, Tokamak Energy are on track to deliver grid-ready fusion power by the 2030s. This ambitious endeavour holds the promise of delivering clean and abundant energy for the future

- using technology developed at the University of Glasgow, Solasta Bio is a UK agritech company that specialises in the next generation of green insecticides. Co-founded by UKI2S, it has raised over £4 million to scale up the development of its unique nature-inspired pesticides, the first of their kind to be developed worldwide

- iFAST Diagnostics is a ground-breaking company that uses rapid diagnostic technology spun out from the University of Southampton to identify antibiotic resistance ten times faster than the current gold standard. Earlier this year, iFAST secured £2 million funding to drive their ambition to improve outcomes and combat antimicrobial resistance, potentially saving thousands of lives

- Babraham Institute spin-out Crescendo Biologics focuses on novel T-cell enhancing therapeutics that use the immune system to treat and manage cancer. In July, it announced a significant investment of $32 million to expand its clinical trials in oncology

- a spinout from the UK Atomic Energy Authority, Luffy AI is delivering the next generation in adaptive intelligence for robotics and industrial control. The company was recently highlighted by Gartner in their ‘Top 10 Tech Trends for 2023’ as one of the leaders in adaptive artificial intelligence

Kickstarting vital discoveries

Science Minister George Freeman said:

Innovation is about the seed of an idea being brought to life and I am proud that public investment is continuing to kickstart vital scientific discoveries, including new cancer treatments and technology to identify antimicrobial resistance, that can transform our society’s health and prosperity.

This funding, reaching over £100 million with today’s investment, has so far supported more than a thousand high-quality jobs across the UK and secured more than £700 million of further private investment, in turn levelling up our country and boosting our economy.

Unleashing the UK’s potential

UKRI commercialisation lead and Innovate UK CEO, Indro Mukerjee, said:

After attracting £700 million of private investment since 2002, UKI2S demonstrates the value of early, patient investment in technology that is driving sustainable growth. In that time, it has nurtured some of the most innovative businesses in the UK in their early years. UKRI is backing UKI2S to unleash the potential from the UK’s excellent research base.

Nationally important technologies

Director of the Defence Innovation Directorate at the MOD, John Ridge, said:

There is a clear need for UK companies to research, develop, commercialise and manufacture sensitive and nationally important defence and security technologies. The Defence and Security fund aims to deliver dual use innovations that ensure the security of our citizens and businesses and give the defence and security services the tools they need to stay safe.

Shaping the future

Andrew Muir, Investment Director at Future Planet Capital Group and Fund Principal for UKI2S, said:

The continuous support and investments from our public sector partners solidify the Fund’s position in the early-stage ecosystem for ground-breaking ideas. We are thrilled to continue enabling the growth of innovative ventures that will shape the future of industries and benefit the UK economy.

Maximising research commercialisation

By investing in innovation from academia and public sector research, often as the first investor, UKI2S helps maximise the commercial value of research and innovation. It achieves this by bringing revolutionary ideas and technologies to market, driving economic gains from publicly funded research.

Investment decisions by the fund are guided by the potential societal impact of technologies and the possibility of financial returns, focusing on key areas such as:

- engineering biology

- defence and security

- fusion energy

- UK public sector knowledge assets including intellectual property, innovation and data

The Medical Research Council (MRC) joins UKI2S

Coupled with their latest injection of funding, UKI2S also welcomes MRC as a new public fund partner. MRC joins UKI2S as a representative of UKRI.

MRC’s expertise in funding medical research, from fundamental lab-based science through to clinical trials, to improve human health will add an important dimension to the activities of UKI2S.

Find out more about how UKI2S is supporting the UK economy and helping high-impact businesses grow by funding innovation from academia and public sector research (PDF, 3.9MB).

Further information

About UKI2S

UKI2S is an early-stage investment fund that nurtures innovative businesses from great UK science to leverage private investment and grow jobs. The fund is backed by the Department for Science, Innovation and Technology and other public bodies, including:

- Animal and Plant Health Agency

- Biotechnology and Biological Sciences Research Council

- Defence Science and Technology Laboratory

- MRC

- National Physical Laboratory

- Natural Environment Research Council

- Science and Technology Facilities Council

- The James Hutton Institute

- UK Atomic Energy Authority

- UK Health Security Agency

- UKRI

UKI2S is independently managed by Future Planet Capital, an impact-led global venture capital firm built to invest in high growth potential companies from the world’s top research centres.