Since 2017, Innovate UK has made investments in loans to almost 200 businesses to support their growth at scale through innovation. We recently invited the founders and chief executives of these inspiring businesses to come together for a day in Swindon around a theme of ’storytelling‘.

These senior business leaders were able to connect with each other, share their experiences and challenges, and form a network to continue their involvement with each other. We have created a short video with feedback from our participants and this blog aims to capture my impressions from the day.

Video credit: Innovate UK

On-screen captions and an autogenerated transcript are available on Vimeo.

The loans story so far

The event was themed around the idea of storytelling, so it was only right that we opened by sharing our own story. Like any other business we developed our new product, modified it, before launching it in the market

Members of our:

- origination team

- lending operations team

- portfolio team

walked us through the Innovation Loans story. Starting out as a £50 million pilot in 2017 it is now a £165 million portfolio of commitments across 200 loans in all sectors of the UK economy.

Innovate UK team members Hemaxi Bhatt, Raquel Da Silva, Emily Maule taking us through the Innovation Loans story (credit: Nigel Walker, Innovate UK)

As the event took place, we were able to announce that our pilot was now a full-scale programme with £150 million in funding available for the next three years.

But our story isn’t just about funding or even about the money deployed to date, it is about what our customers have achieved. We were able to show the early impacts across the portfolio of product and service development, job creation and capital raising as set out in our interim evaluation report.

Recent blogs from two of my colleagues share details about the report findings, and the challenges faced by businesses across our portfolio.

Innovation is not easy – that is part of the story of Innovation Loans, and a big reason why public money is needed to help innovative businesses along their journey.

Panel discussion with Tariq Muhammad of Invatech Health, Julie Purves of B2M Solutions, Ken Cooper of the British Business Bank, and blog author Scott O’Brien, Innovate UK (credit: Nigel Walker, Innovate UK).

Managing scale

We also turned to our portfolio businesses and proven partners to broaden the narrative. In a panel discussion involving me along with:

- Tariq Muhammad of Invatech Health

- Julie Purves of B2M Solutions

- Ken Cooper of the British Business Bank

we discussed the challenges of managing scale in innovative businesses. Our host for the day, was Oli Barrett. Oli made sure that this was a highly interactive discussion involving all delegates, who were open in sharing their challenges and how they’d gone about addressing them.

The biggest scale challenges can be summarised as:

- cash – managing funding strategies

- people – attracting and retaining the best talent

- customers – driving adoption and maintaining traction

- supply chains – dealing with a difficult economic environment.

An event participant said:

It’s interesting to see another 50 to 60 people who are also going through those things. It’s an opportunity for us to learn from each other.

Opening address by Oli Barrett MBE (credit: Nigel Walker, Innovate UK).

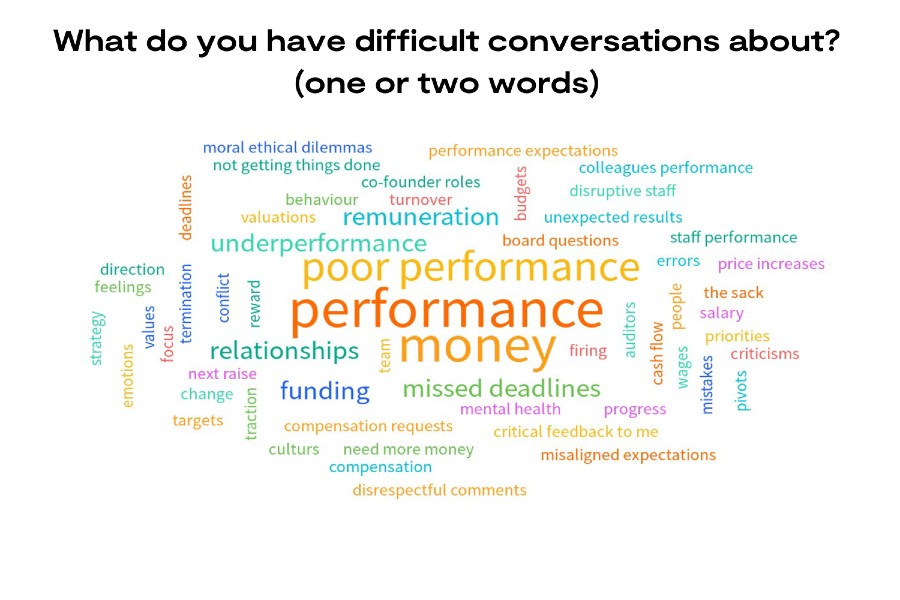

Difficult conversations

What is a story without a little drama? We wanted to surface the challenging conversations business leaders face and consider how to navigate them without that drama becoming a crisis. With a group of senior leaders together with important stakeholders from:

- Innovate UK

- UK Research and Innovation

- Department for Business, Energy and Industrial Strategy

gathered in one place, we had a great opportunity to talk openly about the difficult conversations that Chief Executives face.

A panel with:

- Priya Guha MBE (Merian Ventures and the UKRI Board),

- Hanadi Jabado (Sana Capital and a member of our credit committee),

- Dr Ann Kramer (The Electrospinning Company)

- David Denny (Longwall Ventures)

offered insight into the nature of these conversations and gave advice on how to handle them. We captured a snapshot of what those difficult conversations are about and who they are with from across our participants.

What do you have difficult conversations about? Wordcloud (credit: Nigel Walker, Innovate UK).

Who do you have difficult conversations with? Wordcloud (credit: Nigel Walker, Innovate UK).

An event participant said:

Being a CEO is quite isolating… it’s rare that you get the opportunity just to be yourself and just talk to other people who also have problems.

Realising success

Of course, we want all our borrowers to get a Hollywood ending. So, our final theme was around the path of:

- taking an innovation loan

- carrying out late-stage research and development

- raising further capital

- reaching commercialisation

- considering exits or acquisitions

all aimed at achieving growth. Our final panel focused on these topics, panel members included:

- Hazel Moore OBE (Chair of First Capital and a key supporter of Innovation Loans’ first steps)

- Zuleika Salter (Co-Head of Growth Capital, finnCap Cavendish)

- Neill Ricketts (CEO of Versarien plc)

- Dr Behzad Haravi (CTO of VortexIOT).

Sharing their insights and experience on the next chapter of success.

An event participant said:

We are united by a common need to innovate and scale what we are creating.

Delegates in the Stronger Stories workshop (credit: Nigel Walker, Innovate UK).

Storytelling

Having laid the groundwork for our stories, we turned to Stronger Stories to help our CEOs put their story at the heart of their business planning and development. Our participants learned about:

- the importance of telling a story

- framing a narrative around archetypes

- using their lean story canvas.

This simple framework is designed to help find and create stories to use with employees, customers and investors.

There were times when a disconcerting hush fell over the room as our CEOs worked quietly on their canvases and then a reassuring buzz as they discussed their stories together.

I’m sure that the conversations will continue as the CEOs work further on their stories with their teams back in their offices, labs and factories.

An event participant said:

For engineers and scientists, it’s a tough job to tell our story and we focus too much on the tech. But when talk to investors and the wider community we need to be far more understanding of what they want to hear and how they want to hear it.

Patrick Dodds EngD posted on LinkedIn:

Thank you to Innovate UK for putting on a great portfolio CEO event yesterday. Brilliant workshop from Stronger Stories, informative interactive sessions and the peer to peer networking was invaluable.

What comes next?

It’s great to get people together for a day to “work on the business not just in the business” and to connect, but we want to support our businesses further. Which is why we are joining up our innovation loans CEOs with the scaleup programme alumni community delivered through Innovate UK EDGE and the Scaleup Institute.

Maxine Adam (Deputy Director, Business Growth at Innovate UK) and Irene Graham OBE (CEO of the Scale Up Institute) gave the ‘call to action’. They invited our CEOs to join peer networks, to continue the engagement with a wider network of business seek to achieve growth, scale and success through innovation.

An event participant said:

I would certainly recommend events like this for fellow CEOs in the future. It’s an opportunity to work on the business, not just in the business.

Further information

Connect with Scott on LinkedIn

Follow Scott on Twitter

Follow Innovate UK on Twitter

Connect with Innovate UK on LinkedIn

Follow Innovate UK on Facebook

You can go to the new Innovate UK website

You can go to the Innovate UK EDGE website

Subscribe to our YouTube channel

Sign up for our email newsletter

Top image: Credit: whyframestudio, iStock, Getty Images Plus via Getty Images